Power of Attorney

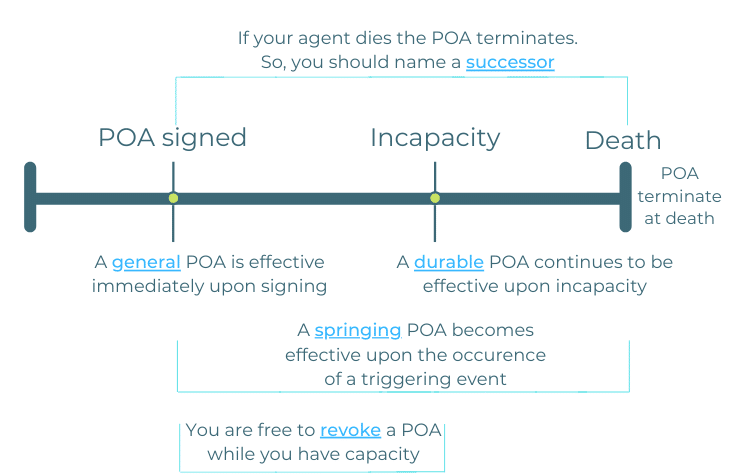

A power of attorney (“POA”) is one of the basic estate planning documents. Sometimes it might be referred to as a financial or durable power of attorney.

A POA authorizes another person, who is called an agent, to make financial, legal, and tax decisions on your behalf.

The POA’s benefit is that if you are incapacitated then financial, tax, and legal decisions can be made without the need for court intervention, which can be expensive and time-consuming.

Incapacity is an inability to manage property or business affairs. Incapacity need not be permanent. For instance, someone under general anesthesia is legally incapacitated.

A durable POA remains effective upon incapacity. As the POA is to be used during times of incapacity, your POA should be durable.

Healthcare Decisions

A POA can also address healthcare decisions.

For the privacy conscious, it is worthwhile to grant this authority in a separate healthcare document, even if you want the same person to make both sets of decisions.

Otherwise, medical providers will receive sensitive financial and legal information and those who are asked to rely on a power of attorney will receive personal medical information.

Typically, this other type of POA is called a Healthcare Power of Attorney (HCPOA).

Choosing a Power of Attorney Agent

Care should be taken to choose the right agent.

Keep in mind that a power of attorney terminates at death. Meaning, an agent cannot administer your probate estate. That is for a personal representative, who is named in your Kentucky will.

Relationship

The first and most obvious consideration is your relationship with the potential POA agent.

This person, if called upon, will be in a privileged position and will have insight into your financial affairs.

So, it goes without stating, choose someone you trust.

Financial Situation

Do not choose someone who may be trustworthy but due to tangential matters should not be tempted.

Meaning, ideally, not someone who is themselves in a poor financial situation.

Financial Literacy

Third, consider this person’s financial literacy.

Your contemplated agent may be entirely trustworthy and have strong financial health. But, if they are financially illiterate they may not be capable of competently handling your affairs.

Location

Someone who is otherwise perfect but who lives across the country is likely a poor choice.

This is because a POA agent is likely to have to handle certain matters in person.

Relationship With Others

Finally, consider your prospective agent’s relationship with other people close to you as you do not want to create a tense situation or facilitate family squabbles.

Successor POA Agent

You should name at least one successor agent so that your POA does not unexpectedly terminate if your chosen agent dies or is otherwise unable to serve.

General vs Springing Power of Attorney

A general POA is effective immediately. In contrast, a springing POA is effectuated only upon the occurrence of a triggering event.

At first, the latter may sound preferable. After all, why should another person have the authority to act when there is no need?

For most folks, the better thought is to choose a trustworthy agent and avoid the ambiguities and associated lag period of a triggering event.

Specific Grants of Authority

A POA should not rely on non-specific grants of authority. Meaning, all powers to be granted should be specifically stated.

Put another way, it is not wise to rely on broad and implicit grants of authority.

Areas often not addressed –